How Advisor Value Has Changed Through the Years

The primary value offered by an advisor has changed through the years.

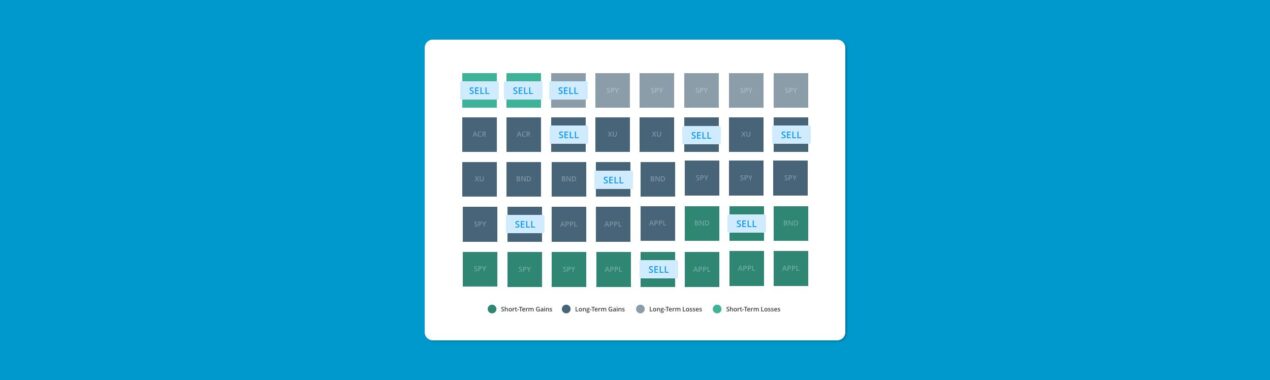

You can see it simply in this image:

| Time Period | Primary Value |

| 1980s and 1990s | Investment Alpha. But we all know chasing returns isn’t a sustainable value proposition. |

| 2000s | Planning Alpha. There’s still a lot of value in planning, but an ever-present difficulty in getting clients engaged and committed. |

| 2010s | Risk Alpha. This happens when great advisors construct the right risk-adjusted portfolios and help clients make (and stick to) the right decisions along the way. |

| Today and the Future | Tax Alpha. When advisors have the ability to save clients real money on taxes — primarily by getting the portfolio to the most optimal place possible while avoiding capital gains — the compounding value of that extra money in the client’s account can blow everything else away. |

In the next section, I’m going to tell you how Nitrogen is advancing rebalancing technology to help you deliver tax alpha by focusing your expertise on the decisions that will make you your clients’ tax superhero.

The New Value Advancement: Intelligent Tax Optimization

If you haven’t already started using Intelligent Tax Optimization in Nitrogen Trading, I’d love to show you how it creates tremendous value for your clients and saves you time.

Let’s say you’ve got a new client who transfers in a taxable account that is currently a Risk 85, and your goal is to get that account to a Risk 55.

The problem is, the client has a pretty low cost basis in a lot of the concentrated stock exposure that is driving all of that extra risk, and getting them to a Risk 55 will generate $100,000 in capital gains.

Intelligent Tax Optimization lets you set a budget for how much in capital gains your client can handle, and then the technology will go to work, generating millions of scenarios for the precise number of shares to sell from the most optimal combination of tax lots to get you as close to the Risk 55 as possible while staying under your capital gains budget.

Here’s a scenario to help you picture how easy Intelligent Tax Optimization makes it.

- The Scenario

Amanda Smith has a large legacy Apple position with multiple tax lots. She wants to sell a little over half of it to buy a more diversified portfolio of ETFs. - The Position Details

She bought Apple at four different times, and all have unrealized gains. Three are long term and one is short term. - The Problem

We need to sell 800 shares. But which tax lots do we sell?If we used a rules-based rebalancer, it would follow the rules—even if those rules don’t allow for the most optimal result. - The Solution: Intelligent Optimization with Nitrogen

All you need to do is select “Avoid short-term capital gains” for Amanda’s portfolio.And instead of just following rules, we’re going to incorporate this client’s tax bracket data to run literally millions of scenarios in seconds and generate precisely the most optimal output.The recommendations are all computed and done for you. Intelligent Tax Optimization determines that it’s best to sell all shares in tax lot three and some in tax lot two. The long-term gains incurred would tack on about $44,500 onto Amanda’s tax bill—but because we know her tax bracket, Intelligent Tax Optimization finds a slightly different combination of shares to sell, in the same quantity, to reduce her capital gains by another $6,000.All of these calculations can dynamically change based on the capital gains budget you set for Amanda. If you increase her capital gains budget to $150,000, you’ll get a completely different recommendation.

The best part is, there aren’t ten steps to review and approve to get this all done. We serve up these scenarios just like an email inbox—so you can accept or snooze the recommendation.

It takes being a one-click fiduciary to an entirely new level.

Nitrogen can optimize accounts with hundreds or even thousands of tax lots at varying gains and losses, and serve up an optimized path to success that turns you into your client’s tax superhero.

There’s so much more to cover about how Intelligent Tax Optimization can make it simple to be tax-conscious while also giving you time back in your day to connect with clients or work on your business.

More on tax alpha: See how we’re putting true automation into automated tax lot harvesting.

See it in action: Catch up by watching Nitrogen’s full product keynote

Dive into the details: Embrace the math behind Intelligent Tax Optimization by downloading our new white paper about why optimization-based rebalancing is superior to rules-based rebalancing.

Talk to a specialist: We’d love to show you around!