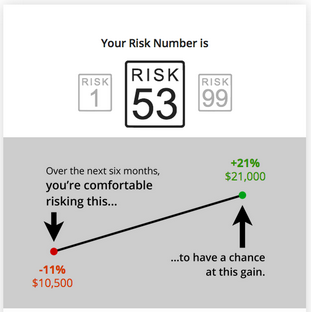

A risk number 53 matches the risk in a typical balanced portfolio with a 60% stock and 40% bond allocation. This means that the average investor may not be psychologically capable of having more than 60% of their portfolio in the stock market.

This should be concerning news to advisors who allocate portfolios using old fashioned rules of thumb, unquantifiable jargon such as “conservative” or “moderate,” or those who put each investor into a one-size-fits-all allocation. It should be equally concerning to advisors who are still using outdated, subjective and qualitative risk tolerance surveys.

Think for a moment about what makes your phone ring. When and why do clients start calling? After a 5% market drop? After a 10% correction? A 20% crash?

This has many implications for practicing advisors. Whether you’re a Nitrogen user or not, an advisor that recommends more than 60% equities to any investor should clearly be documenting an objective reason for doing so. It also suggests that any portfolio with a projected downside greater than 11% over a six-month period warrants a deeper risk/reward discussion with the investor.

High risk can equal high yield, but only if the investor has the stomach to stay invested that way for the long run. That’s why investing people within the bounds of their Risk Number is such a powerful way to harness human behavior and drive client success.

If we can help you with evaluating the risk alignment of your client base, don’t hesitate to let us know!