Nitrogen creates a common language between advisors and clients, allowing you to spend more time building your business and less time managing it.

you’re in good company

Trusted by the best brands in wealth management

Thousands of wealth management firms and financial advisors have propelled their success with Nitrogen.

Because we speak results

WHAT’S IN IT FOR YOU?

Solutions for your firm’s biggest challenges

Create a powerful, interactive client acquisition and retention process that hides in plain sight behind the practice of great advice.

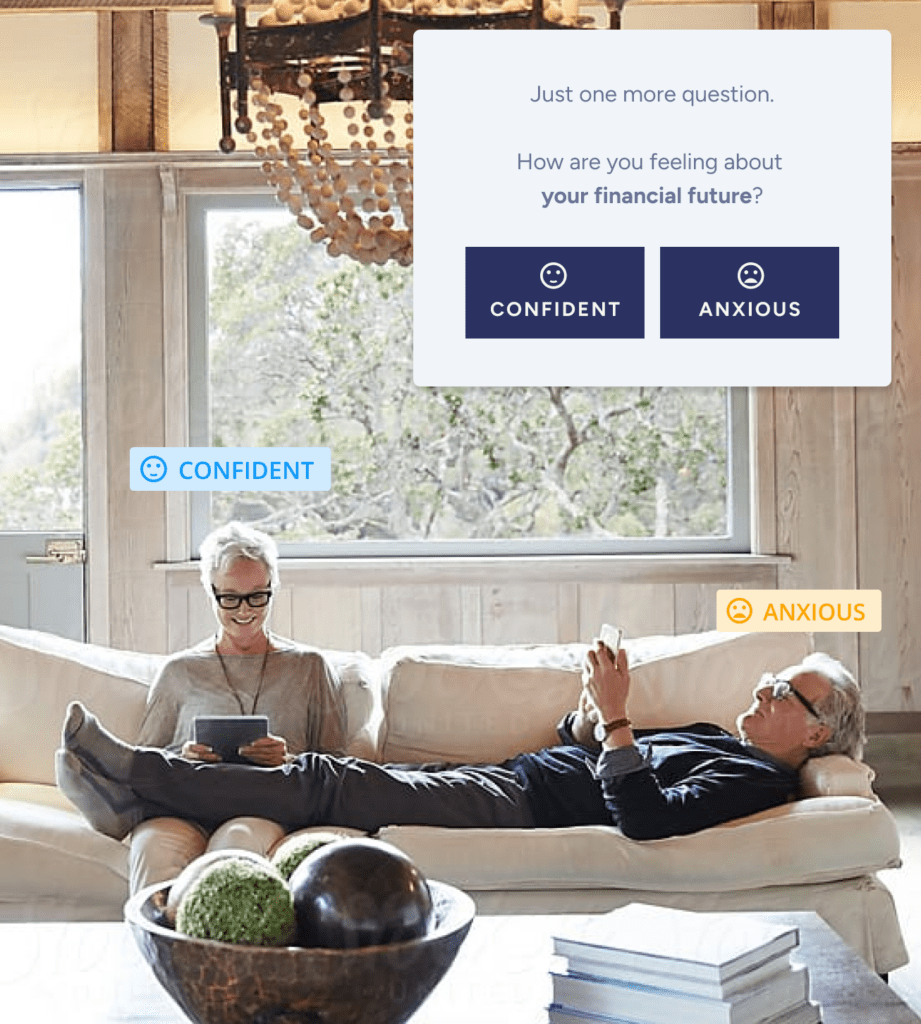

WIN YOUR IDEAL CLIENT

Supercharge your client acquisition

Leverage the four most powerful words in the profession: “What’s Your Risk Number?” When prospects see and understand how they are invested with the Risk Number, advisors can quickly close deals and create ACAT form moments.

WATCH: Advisor Sees 10x Increase in Prospects

ENGAGE WITH YOUR IDEAL CLIENT

Increase client engagement & satisfaction

Create a repeatable, standardized proposal process that sets the right expectations and engages both prospects and clients. Now, you can prove to prospects they are invested wrong, and show clients they are invested right.

READ: Firm Grows AUM by $210m

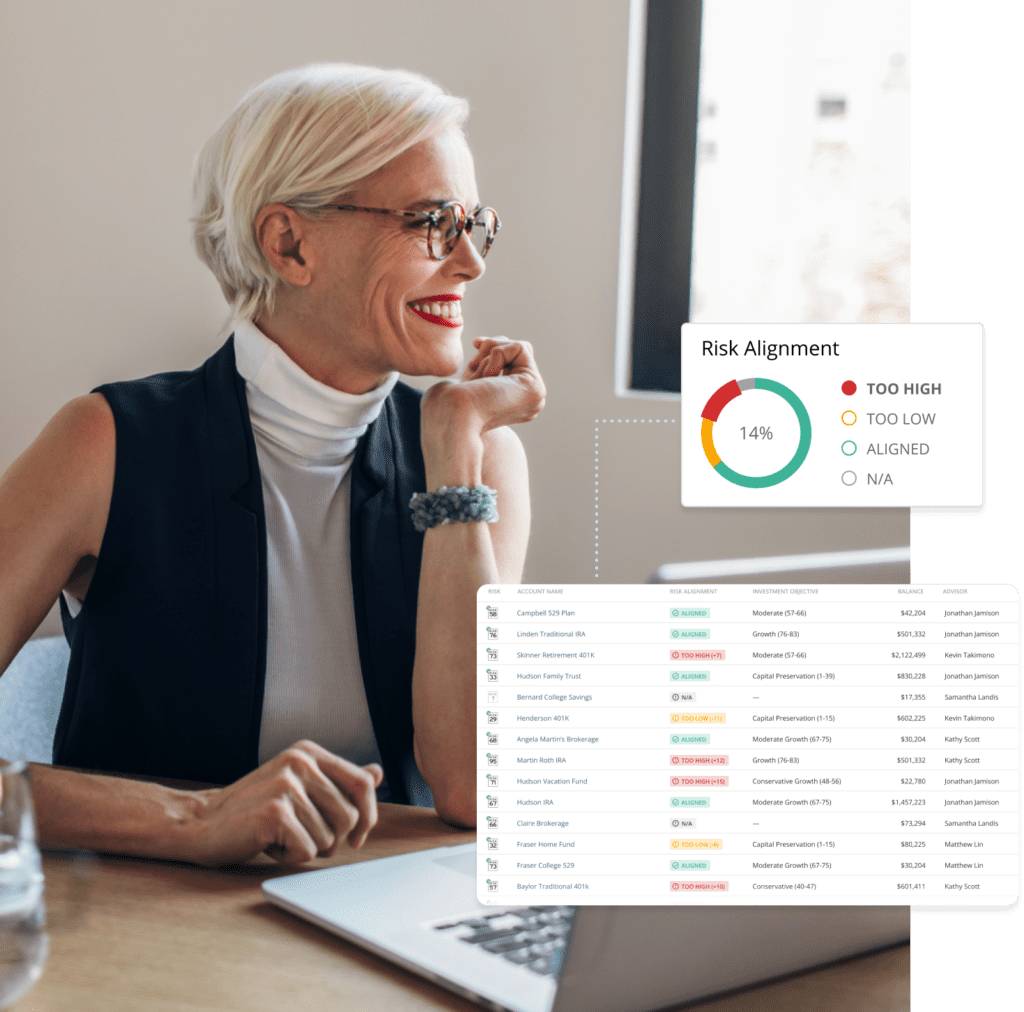

PROVE YOUR FIDUCIARY CARE

Protect your firm with Command Center

See which accounts or households are out of alignment and create a plan to get them back on track. With Command Center, your firm has the tools to measure growth, risk, and proposal delivery across your entire book of business.

READ: Firm Passes Surprise Audit in 60 MinutesSEAMLESS INTEGRATIONS

We integrate with your existing tech stack

You’re only as efficient as the systems around you. That’s why Nitrogen integrates seamlessly with your existing technology, enabling you to connect the Risk Number into all of your wealth tech solutions.

See All IntegrationsCUSTOMER Testimonials

What advisors have to say

book a demo

The markets run on financial advice. Financial advisors run on Nitrogen

Let one of our experts answer any questions and show how thousands of firms like yours have found success with Nitrogen. Book a demo today.